Wake County Real Estate Market: Home Values Edge Up as the Market Eases Into Winter (November 2025)

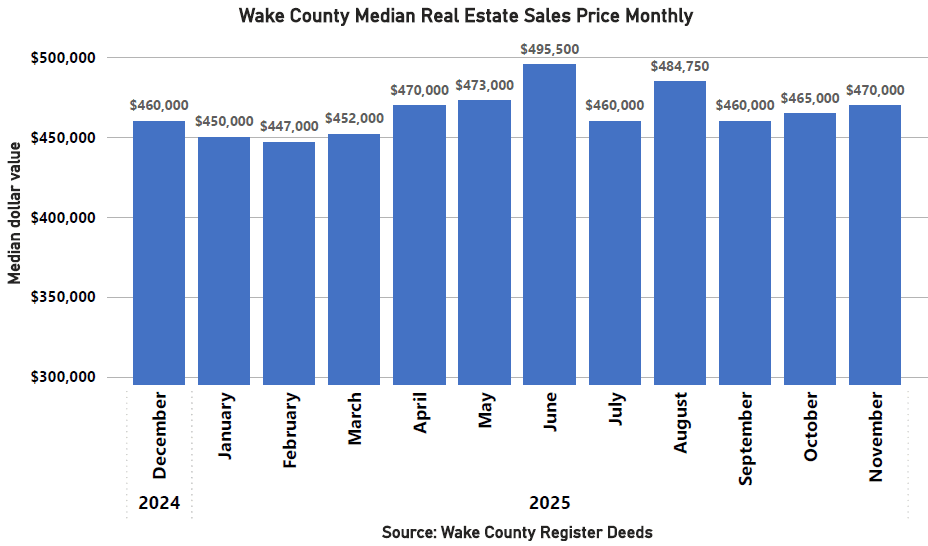

The Wake County real estate market wrapped up November 2025 with home values still trending upward and activity easing into a normal seasonal pace. While the number of sales slowed compared to October, the median sales price climbed to $470,000, showing that demand in the county’s core price ranges remains steady.

Below is a breakdown of what happened in Wake County real estate this November and what it means for buyers, sellers, and investors.

Source: Wake.gov

Median Home Price Rises to $470,000

The headline number for November is the $470,000 median sales price, up $5,000 from October’s $465,000.

That increase is being driven primarily by the core market—properties priced at $1 million or less—which made up 90% of all November transactions. Because there are relatively few luxury deals, high-end sales have very little impact on the median. What really matters is everyday buyers and sellers, and that part of the market stayed active enough to push prices higher.

Bottom line: as we approach the official start of winter, Wake County home values are holding firm and continuing to inch upward.

Sales Volume Softens Seasonally

Wake County recorded 2,501 total sales in November 2025, compared to 2,934 in October. That pullback is in line with what we typically see as the market moves from the busy spring/summer stretch into the holidays.

Here’s how the activity breaks down by price segment:

Core Market (≤ $1M)

- 2,339 transactions

- 90% of all November sales

- Down 391 sales from October

- Total dollar volume down 14.3% month-over-month

This is the “everyday” residential market where most buyers live. The slight step back reflects seasonal timing, not a collapse in demand. Homes are still selling—just at a calmer November pace.

High-Value Market ($1M–$30M)

- 159 transactions

- $391.8 million in total volume

- Down $101.5 million from October

This segment is more sensitive to timing and larger commercial or investment decisions, so month-to-month swings are normal.

Very High-Value Market (≥ $30M)

The top of the market stayed busy, with three $30M+ transactions, matching October’s count:

- Wake Forest Crossing Shopping Center (Wake Forest): $42 million

- 3900 Paramount Parkway (Morrisville): $33 million

- The Yield (Raleigh): $31.5 million

Across all segments, the total sales value for November came in just under $1.2 billion, a strong showing for a late-fall month.

Lending Cools From October But Outperforms Last Year

Real estate lending also followed a seasonal pattern. November saw 2,821 deeds of trust, down from 3,675 in October—a decrease of 854.

However, when you zoom out, November 2025 lending activity was still 3% higher than November 2024, which suggests that both purchase and refinance borrowing remain more active than this time last year.

There are two main types of lending in this data:

- Loans tied to property transfers (typical purchase mortgages when a home changes hands)

- Loans without a transfer of ownership (refinances, second mortgages, equity loans)

In November, Wake County recorded about 1.14 deeds of trust for every deed—suggesting refinance activity remained present but not dominant.

Long-Term Trends: Seasonal, Not Structural

Looking across data from January 2023 through year-to-date 2025, a clear trend emerges:

- Spring and summer months usually bring peak activity

- Fall and winter naturally bring fewer transactions

- November consistently sits in the “slower but stable” part of the cycle

This year’s November fits that pattern. What stands out is that the median price is higher and lending is more active than the same time last year, pointing to a market that remains fundamentally healthy.

What This Means for Buyers, Sellers, and Investors

For buyers: You’re shopping in a market where prices are stable and gradually rising. With activity easing seasonally, there may be slightly less competition than peak spring and summer, especially for well-priced homes in the core market.

For sellers: A higher median price in a slower month is good news. It signals that buyers are still willing to pay strong prices for homes that are properly prepared, priced in line with recent comps, and marketed well.

For investors: The continued presence of high-value and very high-value transactions—including multiple $30M+ deals—shows that institutional and commercial interest in Wake County remains solid, particularly in areas like Raleigh, Morrisville, and Wake Forest.

Final Takeaway

November 2025 was a classic late-year market: slower on paper, but steady where it counts. Values are up, the core under-$1M market is doing the heavy lifting, and lending remains more active than at this time last year.

Source: Wake.gov

Talk With an HREG Expert

Market stats are helpful—but your plans come down to your price range, your neighborhood, and your timeline.

If you’re thinking about buying, selling, or investing in 2026, an HREG agent can help you:

- Understand what these numbers mean for your specific area

- Price your home strategically in today’s market

- Spot opportunities in your ideal neighborhoods and budget

Ready to talk next steps? Call us today at 919-443-5143.